Advertisement

-

Published Date

March 28, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

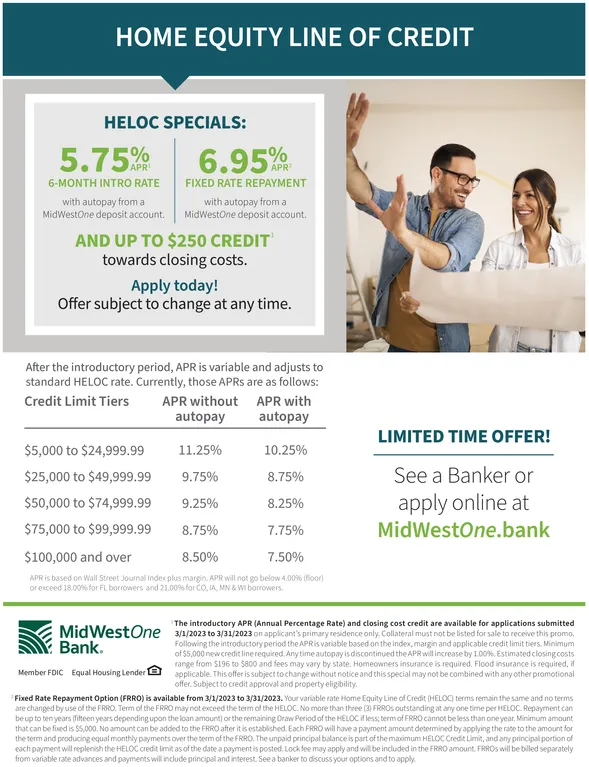

HOME EQUITY LINE OF CREDIT HELOC SPECIALS: 5.75% 6-MONTH INTRO RATE with autopay from a MidWestOne deposit account. 6.95% FIXED RATE REPAYMENT with autopay from a MidWestOne deposit account. AND UP TO $250 CREDIT towards closing costs. Apply today! Offer subject to change at any time. $5,000 to $24,999.99 $25,000 to $49,999.99 $50,000 to $74,999.99 $75,000 to $99,999.99 After the introductory period, APR is variable and adjusts to standard HELOC rate. Currently, those APRS are as follows: Credit Limit Tiers APR without APR with autopay autopay 11.25% 10.25% 9.75% 8.75% 9.25% 8.25% 8.75% 7.75% $100,000 and over 8.50% 7.50% APR is based on Wall Street Journal Index plus margin. APR will not go below 4,00% (floor) or exceed 18.00% for FL borrowers and 21.00% for CO, IA, MN & WIborrowers LIMITED TIME OFFER! See a Banker or apply online at MidWestOne.bank The introductory APR (Annual Percentage Rate) and closing cost credit are available for applications submitted MidWestOne 3/1/2023 to 3/31/2023 on applicant's primary residence only. Collateral must not be listed for sale to receive this promo, Bank. Following the introductory period the APRis variable based on the index, margin and applicable credit limit tiers. Minimum of $5,000 new credit line required. Any time autopay is discontinued the APR will increase by 100%. Estimated closing costs Member FDIC Equal Housing Lender range from $196 to $800 and fees may vary by state. Homeowners insurance is required. Flood insurance is required, if applicable. This offer is subject to change without notice and this special may not be combined with any other promotional offer. Subject to credit approval and property eligibility. Fixed Rate Repayment Option (FRRO) is available from 3/1/2023 to 3/31/2023. Your variable rate Home Equity Line of Credit (HELOC) terms remain the same and no terms are changed by use of the FRRO. Term of the FRRO may not exceed the term of the HELOC. No more than three (3) FRROS outstanding at any one time per HELOC. Repayment can be up to ten years (fifteen years depending upon the loan amount) or the remaining Draw Period of the HELOC if less; term of FRRO cannot be less than one year. Minimum amount that can be fixed is $5,000. No amount can be added to the FRRO after it is established. Each FRRO will have a payment amount determined by applying the rate to the amount for the term and producing equal monthly payments over the term of the FRRO. The unpaid principal balance is part of the maximum HELOC Credit Limit, and any principal portion of each payment will replenish the HELOC credit limit as of the date a payment is posted: Lock fee may apply and will be included in the FRRO amount FRROS will be billed separately from variable rate advances and payments will include principal and interest. See a banker to discuss your options and to apply HOME EQUITY LINE OF CREDIT HELOC SPECIALS : 5.75 % 6 - MONTH INTRO RATE with autopay from a MidWestOne deposit account . 6.95 % FIXED RATE REPAYMENT with autopay from a MidWestOne deposit account . AND UP TO $ 250 CREDIT towards closing costs . Apply today ! Offer subject to change at any time . $ 5,000 to $ 24,999.99 $ 25,000 to $ 49,999.99 $ 50,000 to $ 74,999.99 $ 75,000 to $ 99,999.99 After the introductory period , APR is variable and adjusts to standard HELOC rate . Currently , those APRS are as follows : Credit Limit Tiers APR without APR with autopay autopay 11.25 % 10.25 % 9.75 % 8.75 % 9.25 % 8.25 % 8.75 % 7.75 % $ 100,000 and over 8.50 % 7.50 % APR is based on Wall Street Journal Index plus margin . APR will not go below 4,00 % ( floor ) or exceed 18.00 % for FL borrowers and 21.00 % for CO , IA , MN & WIborrowers LIMITED TIME OFFER ! See a Banker or apply online at MidWestOne.bank The introductory APR ( Annual Percentage Rate ) and closing cost credit are available for applications submitted MidWestOne 3/1/2023 to 3/31/2023 on applicant's primary residence only . Collateral must not be listed for sale to receive this promo , Bank . Following the introductory period the APRis variable based on the index , margin and applicable credit limit tiers . Minimum of $ 5,000 new credit line required . Any time autopay is discontinued the APR will increase by 100 % . Estimated closing costs Member FDIC Equal Housing Lender range from $ 196 to $ 800 and fees may vary by state . Homeowners insurance is required . Flood insurance is required , if applicable . This offer is subject to change without notice and this special may not be combined with any other promotional offer . Subject to credit approval and property eligibility . Fixed Rate Repayment Option ( FRRO ) is available from 3/1/2023 to 3/31/2023 . Your variable rate Home Equity Line of Credit ( HELOC ) terms remain the same and no terms are changed by use of the FRRO . Term of the FRRO may not exceed the term of the HELOC . No more than three ( 3 ) FRROS outstanding at any one time per HELOC . Repayment can be up to ten years ( fifteen years depending upon the loan amount ) or the remaining Draw Period of the HELOC if less ; term of FRRO cannot be less than one year . Minimum amount that can be fixed is $ 5,000 . No amount can be added to the FRRO after it is established . Each FRRO will have a payment amount determined by applying the rate to the amount for the term and producing equal monthly payments over the term of the FRRO . The unpaid principal balance is part of the maximum HELOC Credit Limit , and any principal portion of each payment will replenish the HELOC credit limit as of the date a payment is posted : Lock fee may apply and will be included in the FRRO amount FRROS will be billed separately from variable rate advances and payments will include principal and interest . See a banker to discuss your options and to apply